The Graph explained for beginners

The Graph, also known by the market ticker GRT, is an indexing protocol that helps blockchain networks locate the data they require.

Unlike a project like Chainlink which would source the information for you, The Graph aims to take you to where the information already exists.

For this reason, it is occasionally referred to as the Google of the blockchain because if you’re looking up a query on the blockchain, The Graph can likely help with that.

But what exactly is The Graph?

Well, today we find out!

What is The Graph?

Founded by Jannis Pohlmann, Brandon Ramirez, and Yaniv Tal back in 2017 after becoming frustrated with the lack of tools available to create easy-to-access APIs on Ethereum.

So we’re on the same page, an API is an Application Programming Interface and is essentially a way for two or more computer programs to communicate with each other.

But wait, I also referred to The Graph as an indexing protocol. So, what exactly is an indexing protocol, and what does it do?

In short, an indexing protocol works like the indexing in a book – it helps you find a specific piece of information quickly and means you do not have to go through the entire book trying to find what you’re looking for.

The same thing happens in computing datasets, instead of searching the entire dataset for one specific piece of information, an index can fast-track you to that location.

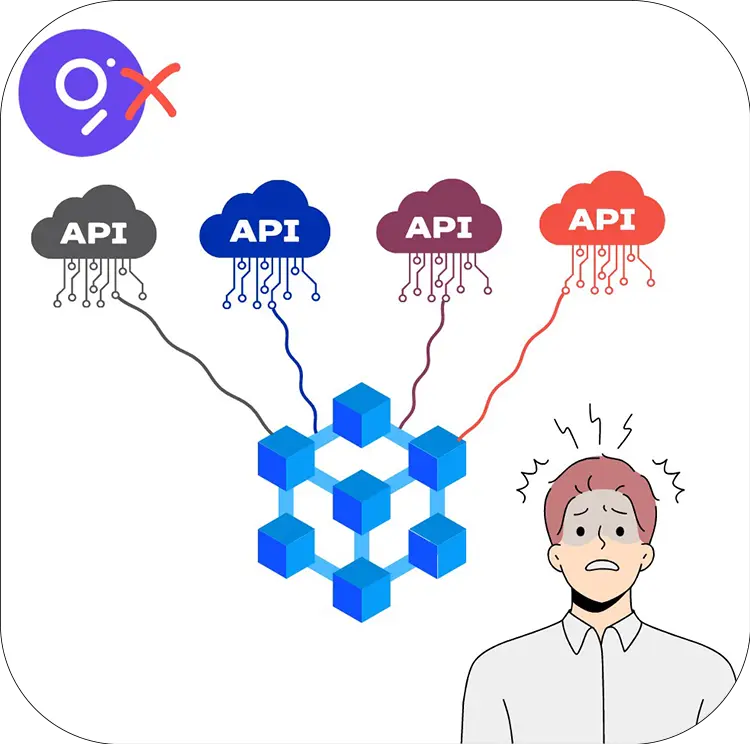

However, the problem currently is the most popular APIs, such as blockchain explorers like Etherscan, store their data off-chain, place it into their own graphs and datasets, and then provide you with an interface to view this data.

While this is mostly fine, it does require putting trust in these centralized companies, which isn’t ideal for a fully decentralized and permissionless network.

So how does this all work?

How does The Graph work?

The Graph is an ERC20 token on the Ethereum network, which means it behaves a lot like the other ERC20 tokens we’ve talked about previously.

But to catch up quickly, an ERC20 token is a token standardization blueprint that ensures compatibility with the Ethereum network.

An ERC20 token is a fungible token, the opposite of the more-famous non-fungible tokens. In short, this means each ERC20 token of its type is worth the same.

A real-life example would be the way a $1 note is always worth $1.

As ERC20 tokens run on the Ethereum network, they all run a variant of Ethereum’s Proof-of-Stake consensus mechanism.

The main difference between Proof-of-Stake and Bitcoin’s more famous Proof-of-Work is that instead of making the entire network compete to solve a puzzle and receive the reward, under Proof-of-Stake, they choose who validates the transactions based on who has the most deposited to the network.

The benefit here is it allows for quicker transaction finalization as it only uses one validator and a couple of authenticators to ensure legitimacy. As a result, Proof-of-Stake uses an unbelievably small amount of energy when compared to Proof-of-Work.

However, I’ve talked about Proof-of-Stake and ERC20 tokens a few times previously. So, I’ll leave a few links to some previous videos here, for those looking for a bit more depth on them.

What makes The Graph unique?

Without The Graph, each company must make their own API to interact with the blockchain which creates a lot of redundant work that could be better used elsewhere.

However, what really makes The Graph unique is sub-graphs.

The Graph can speak to multiple blockchains by using a queryable language known as GraphQL

Queryable information is organized into sub-graphs. Multiple sub-graphs can be used, and a single sub-graph could contain many more sub-graph layers beneath it.

In the same way, your file explorer on your computer can open a folder that only has a few documents, or it can open a folder that has folder after folder after folder.

The sub-graphs can provide a consolidated form of data that can be used through The Graph’s explorer.

Through The Graph’s explorer, you will find popular APIs such as Uniswap, Compound, Balancer, or ENS, to name a few.

GRT Tokenomics

Initially, there were 10 billion GRT tokens, with a new token issuance rate of 3% annually, minus the burn rate.

Of the initial 10 billion, they were distributed as follows. 17% went to early backers, and a further 17% went to other backers.

23% was allocated to the early team and advisors, and 8% was allocated to Edge & Node, which includes the initial development team behind The Graph.

The last 35% was allocated to the Community.

Of that 35%, 58% went to the Graph Foundation, while 18% was sold during the GRT sale. Finally, the rest 24% was given to the Testnet Indexer Rewards, the Curator Program Grants, and the Educational and Bug Bounties Programs.

The GRT token is a utility token that can be used in multiple ways to generate income.

First, we have indexers.

Indexers become indexers by staking to the network and starting a graph node. Their main function is to index relevant sub-graphs.

Indexers can earn rewards for serving queries from their sub-graphs, and they can set their own prices for doing so, creating a fair and competitive marketplace.

Then we have curators.

Curators use their GRT tokens to signal what potential sub-graphs are worth indexing. Curators are rewarded proportionally to how much their sub-graph is then used overall.

Finally, we have delegators.

Delegators stake their GRT on behalf of indexers to earn a portion of the indexer’s rewards and fees. The benefit here is they don’t have to run their own sub-graph and can still earn rewards.

The Graph has a purpose, and that’s when you ask it a question, to provide you an answer.

It encourages a clever ecosystem for users to select, host, and use the technology they have created, and offers multiple ways you can contribute to receive a reward yourself.

Of course, we can’t say The Graph will be the indexing protocol of choice as a guarantee.

However, what I do feel more comfortable saying is, as blockchain technology grows, it will need an interoperable indexing system.

At present, The Graph has set itself up nicely for success, and if it can avoid any major misfalls in management, it will likely continue to thrive for as long as Ethereum does.