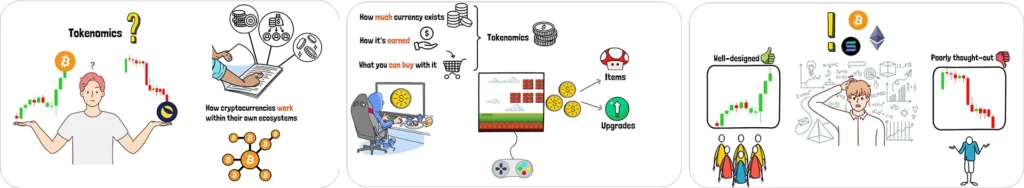

Have you ever wondered why some cryptocurrencies skyrocket in value while others go to zero? The secret often lies in something called tokenomics. But what exactly is tokenomics?

Tokenomics is the study of how cryptocurrencies work within their own ecosystems. It’s like the rulebook that governs how tokens are created, distributed, and used. Imagine a video game where you earn in-game currency by completing tasks, and you can spend it on items or upgrades. The game’s designers decide how much currency exists, how it’s earned, and what you can buy with it. In the world of crypto, tokenomics plays that same role, structuring the economy of a blockchain project.

Understanding tokenomics is important for anyone interested in cryptocurrencies. A well-designed tokenomics model can lead to a project’s success, attracting users and boosting the token’s value. On the other hand, a poorly thought-out model can spell disaster, causing prices to crash and projects to fail.

What is Tokenomics?

Tokenomics is the study of how cryptocurrencies function within their ecosystems, acting as the rulebook for token creation, distribution, and usage. Just like a video game’s economy, tokenomics defines the structure of a blockchain project’s economy.

To understand tokenomics, we need to start with its foundations. The first piece of the puzzle is token supply. This is all about how many tokens exist or will ever exist. There are a few terms you need to know. Total supply is the number of tokens created so far, minus any that have been destroyed or burned.

Maximum supply is the upper limit of tokens that will ever be made. For example, Bitcoin has a maximum supply of 21 million coins, which makes it scarce. Circulating supply is the number of tokens currently available and being traded in the market.

Why does supply matter? It’s all about scarcity. In economics, if something is rare and people want it, its value tends to go up. Tokens with a limited supply, like Bitcoin, can become more valuable if there’s demand. But it’s not just about controlling the supply. How new tokens enter the market also plays a big role. Some projects use mechanisms like halving, where the rate of new token creation slows down over time. Bitcoin, for example, cuts its mining rewards in half every four years, which helps keep inflation in check and supports its value over time. On the other side, a project with an unlimited supply might struggle to maintain value unless it has a strong reason for it, like Ethereum, which uses the ETH token for network operations.

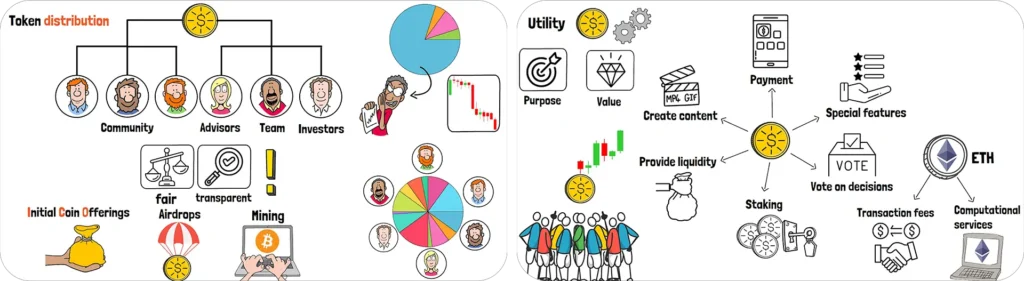

Next up is token distribution, which is how tokens are shared among different groups, like the project team, investors, advisors, and the community. A fair and transparent distribution is vital for a project’s health. If a small group holds most of the tokens, they could flood the market by selling, crashing the price. A broad distribution, on the other hand, promotes decentralization and resilience, as more people have a stake in the project’s success. Many projects distribute tokens through Initial Coin Offerings (ICOs), where anyone can buy in, or airdrops, where tokens are given out for free to build a community. Bitcoin, for example, distributes tokens through mining, allowing anyone with the right equipment to earn rewards and participate in the network.

Now, let’s talk about token utility, which is what a token can actually do within its ecosystem. This is the heart of tokenomics because it gives a token its purpose and value. Tokens can serve many roles:

- Payment: Used for goods or services within the platform, like digital cash.

- Access: Grants entry to special features, like a VIP pass.

- Voting: Allows holders to vote on project decisions.

- Staking: Tokens can be locked up to secure the network and earn rewards.

- Earning: Gained by contributing to the ecosystem, like providing liquidity or creating content.

The more useful a token is, the more people want it, which can drive up its value. Take Ethereum’s token, ETH, as an example. It’s used to pay for transaction fees and computational services on the network, making it essential for anyone building or using apps on Ethereum.

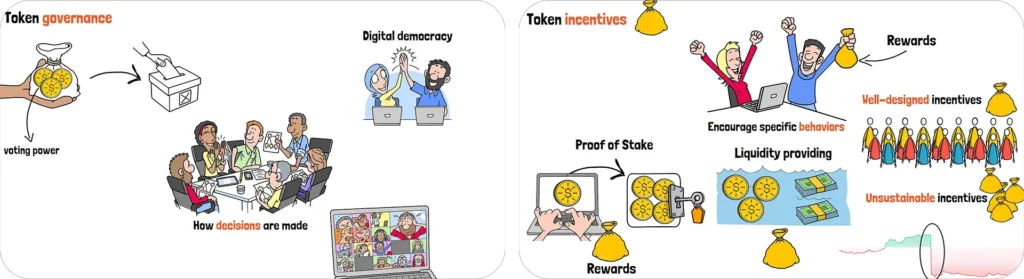

Another key component is token governance, which is how decisions are made in a project. In many blockchain projects, token holders can vote on proposals for the network’s future, like upgrading the protocol or changing the tokenomics. This is like a digital democracy, where your tokens are your voting power. Governance tokens align the interests of holders with the project’s success, as they have a direct say in its direction.

Finally, we have token incentives, which are designed to encourage specific behaviors within the ecosystem. These are like rewards in a game that motivate you to keep playing. For example, in Proof of Stake (PoS) systems, you can stake your tokens to validate transactions and earn rewards, which makes the network more secure. In Decentralized Finance (DeFi), users might provide liquidity to trading platforms and earn tokens as a reward. Well-designed incentives can attract users, bootstrap the network, and promote long-term growth. However, if incentives are too generous or unsustainable, they can backfire, as we’ll see later when we look at some examples.

Key Components of Tokenomics

Tokenomics consists of several critical elements that define a token’s economy. These components work together to shape the token’s value and the project’s success.

a. Understanding Token Supply

Token supply refers to the total number of tokens in existence, including total, maximum, and circulating supply. Scarcity, driven by limited supply, can increase a token’s value if demand is high.

b. The Importance of Token Distribution

Token distribution determines how tokens are allocated to teams, investors, and the community. Fair distribution promotes decentralization and project resilience.

c. Token Utility: What Can It Do?

Utility defines a token’s purpose within its ecosystem, such as payments, access, or governance. Strong utility drives demand and value.

d. Governance in Tokenomics

Governance allows token holders to influence project decisions, fostering a decentralized and community-driven approach.

e. Incentives and Their Role

Incentives encourage user participation, such as staking or providing liquidity, but must be sustainable to avoid long-term issues.

The Impact of Tokenomics on Token Value

Tokenomics directly affects a token’s value by balancing supply and demand. Limited supply, strong utility, fair distribution, and smart incentives can drive up demand and price, while poor design can lead to failure.

So, how do all these pieces come together to affect a token’s value? In simple terms, good tokenomics creates a balance where demand outpaces supply, driving up the price. A token with a limited supply and strong utility is likely to be in high demand, as people need it to use the platform. Fair distribution and transparent governance build trust, attracting more users and investors. Smart incentives keep the ecosystem active and growing. On the other hand, if a token has no clear use, an unfair distribution, or poorly designed incentives, it might struggle to gain traction.

Case Studies in Tokenomics

Examining real-world examples helps illustrate how tokenomics can lead to success or failure.

a. Ethereum: Building a Strong Ecosystem

Ethereum’s token, ETH, powers smart contracts and decentralized apps, with its utility and community governance driving its success.

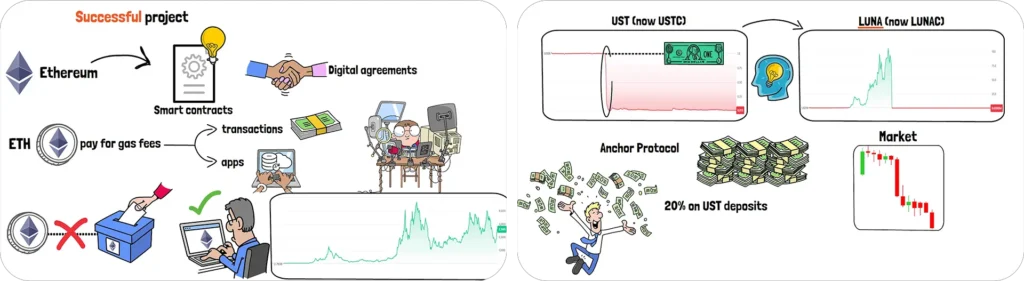

An example of a very successful project is Ethereum, which pioneered smart contracts. Smart contracts are essentially digital agreements on the blockchain. Ethereum’s native token, ETH, is used to pay for gas fees, which are the costs of making transactions or interacting with apps on the network. This makes ETH necessary for developers and users. While Ethereum’s governance isn’t directly token-based, its community of developers, miners, and users plays a big role in decision-making. These factors have helped Ethereum grow into a very strong project, supporting thousands of decentralized applications.

b. Terra: When Tokenomics Goes Wrong

Terra’s UST stablecoin and LUNA token collapsed due to unsustainable incentives, highlighting the risks of poor tokenomics design.

Now, let’s look at the collapse of Terra’s UST stablecoin and LUNA token in 2022. Terra aimed to create a stablecoin, UST, pegged to the US dollar, using an algorithmic system balanced by LUNA. The idea was clever, but the tokenomics had a fatal flaw. Terra’s Anchor Protocol offered super high yields of nearly 20% on UST deposits, attracting huge amounts of capital. However, these rewards relied on constant growth and market confidence. When the market turned bearish, investors pulled out, UST lost its peg, and LUNA’s value plummeted in a death spiral. Billions of dollars were wiped out, showing how unsustainable incentives can destroy even a promising project.

How to Evaluate a Cryptocurrency Project

To assess a cryptocurrency project, focus on its tokenomics: look for clear utility, fair distribution, and sustainable incentives. Avoid projects with vague plans or overly generous rewards.

Tokenomics is the backbone of any cryptocurrency project. It covers the supply, distribution, utility, governance, and incentives that determine a token’s fate. By understanding these elements, you can better evaluate which projects are worth your time or money. Look for tokens with clear utility, fair distribution, and incentives that promote long-term growth. Avoid projects with vague plans or unsustainable rewards, as they’re more likely to fail.